Dr. Leana Wen Just Said The Quite Part Out Loud!

Pay very close attention to exactly what she is saying. Remember that most people are not going to be able to hear this repeated on live TV. Which is why catching these sorts of things are important.

Those who are vaccinated, we now know, because of the CDC... They are now able... But with the Delta Variant, because they carry so much more virus. [The vaccinated] They could transmit it to their unvaccinated family members, and so, I for example, even though I’m fully vaccinated. My children are not, because they’re too young to be vaccinated. So, I need to be now careful for my children, because of all the unvaccinated people around us.

She is saying that the vaccinated carry a higher viral load than the unvaccinated, so they can more easily spread the virus. But, she is worried about the unvaccinated people that might spread it to her?

I’m afraid she just let the cat out of the bag. It’s the vaccinated who are spreading the Delta Variant. If the vaccines are working, why would those who are vaccinated have a higher viral load than the unvaccinated?

The unvaccinated often are already immune to the Delta Variant, because of their natural immunity from the first round of COVID. Those who are infected by the wild virus and build a natural immune response, have a response to more parts of the virus than just the spike protein. Because of this, the variants are much less likely to have a severe effect on those with natural immunity.

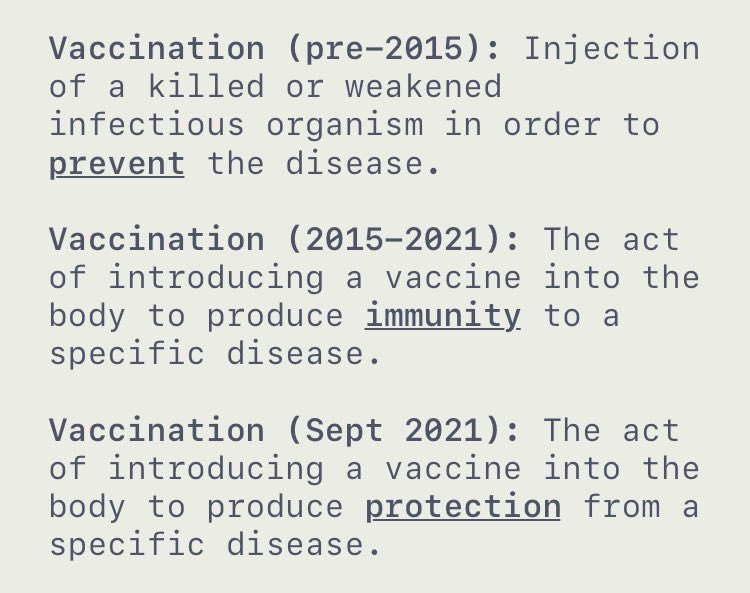

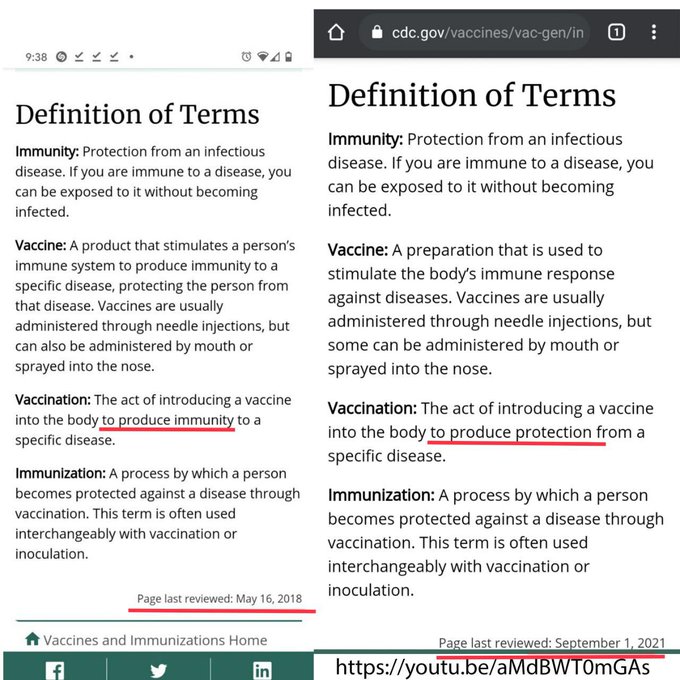

And now you know why the CDC changed the definition of "VACCINE."

To fully understand the importance of the change, it’s crucial to note that, before the COVID pandemic, the definition of a vaccine had been relatively stable for nearly a couple decades with minor word changes occurring every few years. All through that time the intent of a vaccine — to give you immunity by protecting you from a specific disease — had remained basically the same.

For example, according to an archived snapshot of the CDC’s website, the definition of a vaccine February 24, 2011, was:

“A product that produces immunity therefore protecting the body from the disease. Vaccines are administered through needle injections, by mouth and by aerosol.”

By July 2015, the wording had changed to:

“A product that stimulates a person’s immune system to a specific disease, protecting the person from that disease. Vaccines are usually administered through needle injections, but can also be administered by mouth or sprayed in the nose.”

The wording was the same in June 20179 and likewise in June 201910 and June 2020.11 By August 26, 2021, however, the definition had changed slightly to add the words “to produce immunity”:

“A product that stimulates a person’s immune system to produce immunity to a specific disease, protecting the person from that disease. Vaccines are usually administered through needle injections but can also be administered by mouth or sprayed into the nose.”

Then, less than a week later, just days after the FDA gave final approval to Pfizer’s mRNA jab, the definition changed again, September 1, 2021 — this time, significantly. The definition of a vaccine now reads:

“A preparation that is used to stimulate the body’s immune response against diseases. Vaccines are usually administered through needle injections, but some can be administered by mouth or sprayed into the nose.”

As you’ll note, the second sentence remains the same. It is the first part of the definition that has dramatically changed. In the latest definition, a vaccine:

- Is no longer a “product” but instead is a “preparation”

- No longer "stimulates the immune system," but is said to "stimulate the body's immune response"

- No longer "produces immunity"

- Stimulates the immune response "against diseases," not against a "specific disease"

- No longer "protects a person from [that] disease"

These dramatic changes were likely created to allow the CDC, FDA and other governmental agencies to call the genetic therapy experiment being administered worldwide a “vaccine” — while they knew full well the so-called “vaccine” was not created to either produce immunity or prevent transmission of disease. In fact, by any definition of a vaccine in use before 2021, this jab is not a vaccine.

People like Dr. Leana Wen must have some kind of disconnect between their ability to speak and comprehend. If their goal is to get people to run out and take the vaccine, telling them that once they do, they are more likely to spread the virus --is not a good selling point.

Knowing what we know now, how is anyone to believe that the vaccine is going to help people? Now that we know that the vaccinated spread infection at a higher rate, what's the point? The whole goal from the start of this "pandemic" was to "stop the spread," "flatten the curve." But the vaccines won't do that, and the evidence proves that out. They might provide a level of protection against symptoms for a limited amount of time, where natural immunity is lifelong, we have to assume that because there is no data claiming that it doesn't. In fact all of the data available shows that natural immunity is lifelong.

If you follow the vaccine narrative to its conclusion. You will have vaccinated everyone, but those people are still going to be infected, and won't gain long term immunity. When their vaccine wears off, they'll have to get a booster, then they'll have to get another booster after that in perpetuity. Why would anyone agree to that, when the natural path to immunity is safe, and lifelong?

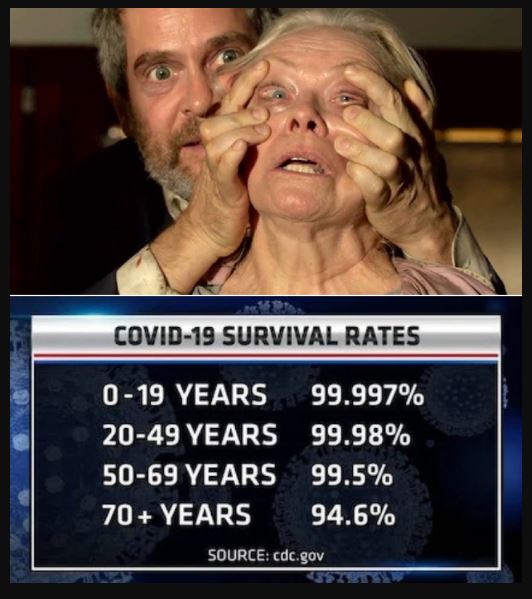

Then there's the fact that more than 99% of healthy people who contract COVID, will recover. Remember that the number of people with comorbidities had (3) on average. None of this adds up.

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

What Looks Like A Victory For Republicans, Might Not Be

Democrats have a problem. They have done things that have angered the general public. Whether Democrat voters want to admit it or not. I guarantee that very few of them voted for any of the things that have happened recently on the National level. That is to say, I haven't seen anyone defend the Biden administration on their Afghanistan withdraw, or beg for more lockdowns.

The Senate Parliamentarian voted not to allow immigration law to be included in this budgetary bill.

Finally, it is important to note that an obvious corollary of a finding that this proposal is appropriate for inclusion in reconciliation would be that it could be repealed by simple majority vote in a subsequent reconciliation measure. Perhaps more critically, permitting this provision in reconciliation would set a precedent that could be used to argue that rescinding any immigration status from anyone - not just those who obtain LPR status by virtue of this provision -- would be permissible because the policy of stripping status from any immigrant does not vastly outweigh whatever budgetary impact there might be. That would be a stunning development but a logical outgrowth of permitting this proposed change in reconciliation and is further evidence that the policy changes of this proposal far outweigh the budgetary impact scored to it and it is not appropriate for inclusion in reconciliation.

In other words, if you can pass an immigration reform law as part of a budgetary measure, granting citizenship to hundreds of thousands of people, you could also strip that citizenship away using another budgetary law. Point being, you shouldn't mix immigration laws with budgetary laws, because they can be changed too easily, and huge swaths of people will be stuck in the middle.

But there's more to it than that I believe.

Congressional Republicans praised the parliamentarian's decision Sunday. Iowa Sen. Chuck Grassley, the top Republican on the Judiciary Committee, tweeted that the parliamentarian "confirmed [the] obvious: mass amnesty for millions of illegal immigrants isn’t a budgetary issue appropriate for reconciliation." Senate Minority Leader Mitch McConnell (R-Ky.) added, "Senate rules never contemplated a majority circumventing the filibuster by pretending that sweeping and transformational new policies were mere budgetary changes."

ecades of failing to enact their amnesty agenda, Democrats tried this latest unprecedented gambit," McConnell said. "It was inappropriate and I'm glad it failed.”

What does this mean? It means that they are not going to legalize the Dreamers with a budget reconciliation bill.

However, I believe that this is a setup. The Democrats have wanted to pass the legislation (H.R. 1 / S. 1) ever since the 2020 election. These/this is the legislation that basically makes every aspect needed to steal an election legal. Yes that's right, everyone would be able to vote, regardless of whether you are here legally or not. It's the "Democrats Stay In Office Forever Plan." But this is such a purely political move that it would be impossible to try and explain it away. Democrats haven't made much ground when it comes to convincing people that it's too hard to vote. Not because they are not good at marketing, it's because it's a lie, and everyone knows it. Voter ID laws don't exclude anyone, especially the poor. Anyone on government assistance has to be identified. If they can provide identification for welfare / government assistance, they can provide identification to vote. Everyone knows this.

I think that they Democrats want to remove the filibuster, but they haven't been able to find a "cause" to do it. If they were to remove the filibuster to pass "voter reform" it would be an obvious and open political move. The Democrats need something that they can argue is for helping people --like the Dreamers!

I believe that they are going to remove the filibuster rule so they can pass "immigration reform." The democrats want to save the Dreamers. That way they can pull on people's heart strings and appear to have someone else's interest in mind.

Now you know why the SCOTUS ruled that the Trump administration couldn't end the DACA program. I believe that this has been their plan all along. That's why they went so far with the 2020 election fraud. They have all of this planned out and they couldn't get it done with another year of Trump in office.

With the filibuster removed, they can pass (H.R. 1 / S.1) and stay in power for as long as they want.

What do you think?

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

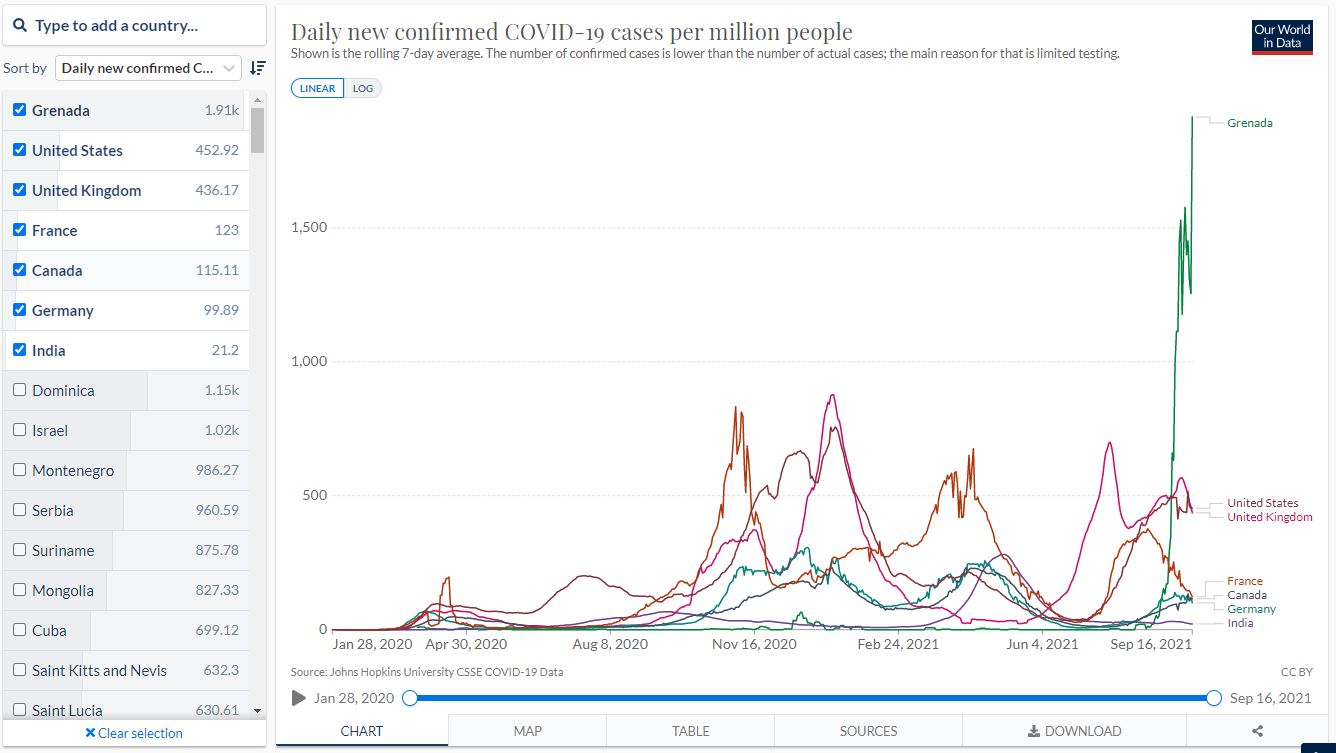

Grenada

Yes, this Grenada!

There's a serious outbreak of COVID-19 in Grenada, but the timing it what makes it so interesting. Since the beginning of the pandemic, Grenada has had an extremely low infection rate. But just over the past 30 or so days, Grenada has experienced a massive spike in cases.

Click on the image below to see full size.

These spikes have happened everywhere at some point or another. The timing is What makes the spike in Grenada interesting. Grenada's COVID-19 infection rate has been flat for nearly the entire year. Much flatter than most other countries.

Grenada has a relatively small population, so the data coming from there is more accurate than some of the larger countries.

Click on the image below to see full size.

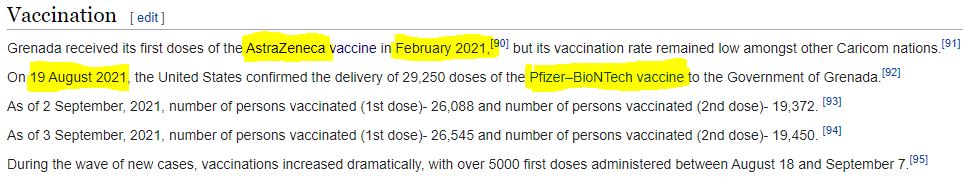

Grenada imported the AstraZeneca vaccine in February 2021, and the cases remained flat. On August 19 Grenada imported the Pfizer–BioNTech vaccine. The government of Grenada started an aggressive program to get people vaccinated as soon as the Pfizer vaccine was imported, then a huge spike occurred. Is this a coincidence? You be the judge.

It's hard to explain how Grenada was pretty much COVID free for nearly the whole year, and then they start seeing a huge spike in cases -- right around the time they start administering the Pfizer vaccine. That's very suspicious to say the least.

Tell me what you think.

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

See Why They Are Pushing Vaccines So Hard?

In case you haven't been paying attention; a new vaccine mandate has been issued by the federal government.

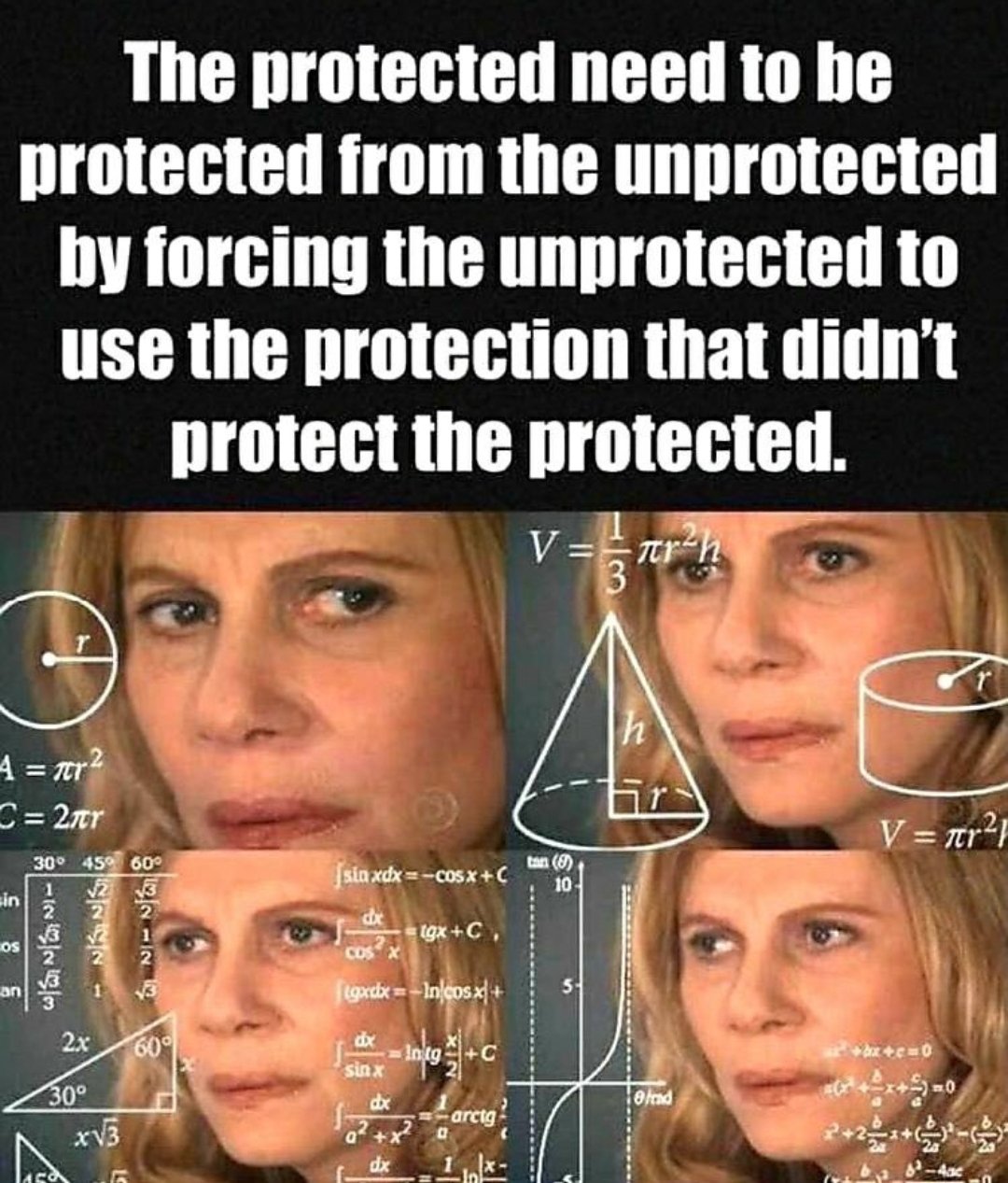

We now know that the vaccines are ineffective against the Delta Variant. So, why all the push now? Well, the answer might not be what you are expecting.

Since the onset of the COVID-19 Pandemic, people have worked together for the most part. There was no real contention between those who were infected, vs. those where were not. People isolated at home, had food delivered to their front door, and things were working without much stress. Amazon was making tons of money.

In come the vaccines. As soon as it was announced that there was a vaccine that would provide immunity, people jumped on-board, because they were promised that the lockdowns and mask mandates would eventually be eliminated. Those restrictions would be lifted once we met some magic percentage of the population that were vaccinated. However, this didn't account for the number of people who had already been infected with COVID-19 and recovered from it. It also didn't account for the fact that as time went on, more data came out which showed that the vaccines didn't do nearly what was promised at the onset. This made people leery of taking the vaccine, especially those people who had already recovered.

Once it was found that the vaccines didn’t provide nearly the level of protection that was promised, did the government change their outlook on vaccinations? No, they doubled down on them. Government officials went on television and told the public that it’s the unvaccinated people who are really spreading the virus. “We need to protect the vaccinated from the unvaccinated?” Of course this makes no sense, because if you’re vaccinated, you shouldn’t have to worry about the virus. That was the entire point of the vaccine, or any vaccine for that matter. Then data comes out that shows that the vaccinated who are infected carry a greater viral load than those where are unvaccinated. Meaning that those who are vaccinated can spread the virus just as easily, if not easier, than those who are unvaccinated. Not only was the original premise false, but the reality was literally the other was around. Why would government officials go on television and say something that they know is false? I believe these polls will show you exactly why.

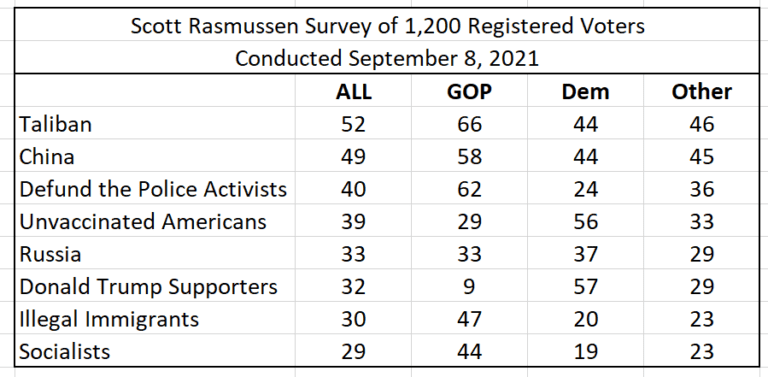

The entire vaccine push has been about division. And recent polling proves this. More Democrats are more worried about the unvaccinated than are worried about China, The Taliban, Russia, and Illegal Immigration. What this data tells us is that the population, at least a large part of the population, has bought into the vaccine propaganda.

NEW YORK — The coronavirus vaccine has been an incredibly divisive topic, and now it’s even ending friendships. Vaccinated Americans have called it quits with friends who refuse to get the COVID-19 shot, according to a new poll.

A survey of 1,000 Americans – conducted by OnePoll on Sept. 2 – examined why people have ended friendships in the last year and a half. Results show 16 percent of respondents have axed three pals from their lives since the pandemic began in March 2020.

Of those who ended a friendship, 66 percent are vaccinated and 17 percent don’t ever plan to receive the shot. Fourteen percent of vaccinated respondents — about 1 in 7 — say they parted ways with friends who didn’t want to get the vaccine. Even “Friends” and “The Morning Show” star Jennifer Aniston claims she’s ended friendships over vaccination beliefs.

Once you see these numbers and realize what’s going on, you can understand why the government has spread misinformation about their own program. It's helping to divide people on a large scale. If division is your objective, then these numbers are very promising.

These recent moves have all been to divide people. And the numbers are showing, it’s working. Now they have enacted mandates, to make those people who don’t want the vaccine a second class citizens, even furthering the divide.

Now you have to ask yourself, who benefits from all of this? Who can get more done with the country divided? I'll give you the short answer, the enemies of The United States, that's who benefits from this. The Biden regime wants division. At the end of the day, there can be no other reason for pushing a vaccine that’s minimally effective.

They are trying to divide the people because divided we are easier to control. Think mandates, vaccine passports, how else are they going to get a majority of the population to go along with these measures. Why do you think that the UK just dropped the vaccine passport idea, at least for now? Because the people of the UK are not divided enough for these measures to work.

Sky News — “If you divide any society into two distinct classes of people you have abandoned liberty and democracy and replaced it with tyranny, fear and suspicion.”

What do you think?

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

FDA Opens The Door To A Nationwide Healthcare Worker Shortage Via Forced Vaccinations

(Originally posted 08/23/21)

I'm going to keep this at the top of the page for a while, because I think it's important that people understand what is going on. There have been two updates about hospital "closures / reduction of services" since I first posted this. They are referenced below.

Newer posts will be below this post.

This is a point of contention for many people within the healthcare industry, and in general. Now that the vaccines are approved for use by the FDA, more mandates are on the way. Not only that, but the approval was pushed ahead, it wasn't supposed to happen until after Labor Day.

There are many in the healthcare industry that don't want to take the vaccine, for too many reasons to list here. This is widely known. There have been large demonstrations by healthcare workers opposing the vaccine mandates by their employers.

The employer mandates are going to lead to an inevitable shortage of healthcare workers as many will quit their jobs before they will take the mandated vaccines. Couple that with the fact that many of the nations hospital systems are already strained.

Hospitals and lawmakers in states gripped by the Delta variant are offering nurses tens of thousands of dollars in signing bonuses, rewriting job descriptions so paramedics can care for patients and pleading for federal help to beef up their crisis-fatigued health care workforces.

The alarming spread of new cases is draining the pool of available health workers in ways not seen since the pandemic’s winter peak, forcing officials to improvise and tear up rules dictating who cares for whom. Governors and hospital directors warn that the staffing crisis is so acute that patients, whether suffering from Covid-19, a heart attack or the effects of a car accident, can no longer expect the level of care that might have been available six weeks ago.

“The scenario we feared in 2020 is, unfortunately, now, a reality,” said Becky Hultberg, president of the Oregon Association of Hospitals and Health Systems, which is calling in the National Guard for help and suspending many non-emergency surgeries as it nears its ICU capacity.

09-03-21 Update: Poll in Ohio shows just how far this might go.

A survey by an Ohio nurses’ union for the University of Cincinnati Medical Center (UCMC) found that almost a third of respondents would quit their jobs if UCMC officially finalized a Covid vaccine mandate, of which the hospital has made a preliminary announcement.

While UCMC did agree to “negotiate the vaccine policy” with the nurses’ union, according to Mendiola, the first date that was set for bargaining, August 23, fell through. “They canceled due to stating that they were unable to allow two of our nurses off of the floor for four hours to do the bargaining due to staffing concerns,” Mendiola explained.

The nurses union couldn't even negotiate the vaccine policy, because the hospital couldn't afford to let two nurses off for four hours to negotiate. They can't negotiate with the union --do to staff shortages. Wouldn't that be reason enough to drop the vaccine mandate policy? The absurdity of the situation is amazing. As a patient, would this situation instill confidence in the decision making capabilities of hospital and its employees?

Pushing up the vaccine approval has necessarily caused many within the healthcare industry, opposed to mandates, to look for work elsewhere. Meanwhile there's a shortage of healthcare workers nationwide. I believe this was done on purpose. Because this will put even more pressure on people to become vaccinated.

Notice how the narrative on the vaccines have shifted since the beginning. At first the vaccine was going to prevent people from catching SARS-Cov-2, then that was walked back. Then it was going to reduce the spread of SARS-Cov-2, then that was walked back. Now we're all the way down to, "The vaccines might reduce your symptoms should you contract SARS-Cov-2."

The people who have already been vaccinated have questions now. They were sold a bill of goods. The vaccinated are worried and looking for answers, but science doesn't have a good answer for them.

Anecdotes tell us what the data can’t: Vaccinated people appear to be getting the coronavirus at a surprisingly high rate. But exactly how often isn’t clear, nor is it certain how likely they are to spread the virus to others.

All that said, some facts are well established at this point. Vaccinated people infected with the virus are much less likely to need to go to the hospital, much less likely to need intubation and much less likely to die from the illness. There’s no doubt that vaccines provide significant protection. But a large proportion of the nation -- almost 30% of U.S. adults -- have not been vaccinated, a fact that has conspired with the highly contagious delta variant to push the country into a new wave of outbreaks.

For the time being, there are simply more questions than answers. Are breakthrough infections ticking up because of the delta variant, waning immunity or a return to normal life? Are vaccinated people more vulnerable to severe illness than previously thought? Just how common are breakthrough infections? It’s anyone’s guess.

“It is generally the case that we have to make public health decisions based on imperfect data,” Frieden said. “But there is just a lot we don’t know.”

09-15-21 Update: Another hospital might have to close because of the vaccine mandate.

This stands to reason. The people who were working on the front line, hospital workers and emergency personnel "essential employees" already took on the risk of infection. Many were infected and recovered. Since they took on the risk of infection, they're being told that it wasn't enough. Now they have to submit to taking a vaccine that might pose a great risk to their health --with literally zero benefit. These workers know better. They were there at the peak of the pandemic, they can't be convinced now that they are going to drop dead without a vaccine. If the virus was a serious threat to these people they would know it by now.

The entire narrative has been blown apart, there is no more logical "scientific" leverage for the vaccines. That's why they are taking people's choices away, because they knew that they were going to loose the argument from the start. If what they have said, and are saying were true. People wouldn't need to be coerced into taking the vaccine. There wouldn't be vaccine lotteries and all of the other wacky ideas they've come up with to bribe people into taking the vaccine.

Remember this. If the vaccine is mandated at any point --it was never voluntary. Of course people will argue that it's still voluntary, like the income tax. You don't have to pay income taxes either, they are officially voluntary in the United States, but if you don't pay your income taxes, the IRS will seize your assets and you'll end up in jail. Those are your options for the voluntary income tax. The vaccine mandates will operate in much the same way.

09-24-21 Update:

Now we hear that COVID will be like the common cold. What they forget to mention is that it was already like the common cold!

Professor Dame Sarah Gilbert and Sir John Bell have both said coronavirus will eventually cause illness which are as mild as a common cold, playing down fears of a more deadly variant and adding the UK "is over the worst".

"Those who do not get vaccinated will immunize themselves naturally, because the Delta variant is so contagious," he added.

"In this way we will end up in a situation similar to that of the flu. You can either get vaccinated and have a good winter. Or you don't do it and risk getting sick and possibly even ending up in hospital."

Asked if that meant a return to normal in the second half of next year, he said: "As of today, in a year, I assume."

People are rarely hospitalized for the flu. Another thing to consider, do they perform flu tests for everyone that walks in the E.R. --right now? Did they ever test everyone that came into the E.R. for the flu? They test everyone that comes into the E.R. for COVID --regardless of why they are there. My friend works at a local hospital, and a patient was telling her about it. He thought it was odd that they tested him for COVID because he was in there due to a work-related injury to his arm. He tested positive, but he wasn't sick. I wonder why the COVID numbers are so high?

09-28-21 Update:

New York healthcare workers will be FIRED if not vaccinated.

New York Governor Kathy Hochul said she is not budging on a vaccine mandate for healthcare workers and vowed to those who do not get the shot by the September 27 deadline that 'we will be replacing people.'

Hochul reiterated her hardened stance even as some hospitals face staff shortages and a lawsuit was launched by 17 doctors, nurses and other healthcare professionals who say New York's requirement violates their constitutional rights in various ways.

'To all the healthcare providers, doctors and nurses in particular who are vaccinated, I say thank you. Because you are keeping true to your oath,' Hochul told WHAM-TV during a visit to Rochester on Wednesday.

'To those who won't, we will be replacing people.'

This sounds much less like a "thank you" and more like, "If you don't tow the party line, we'll find someone who will."

New York Gov. Hochul said Friday that the state will deploy the National Guard to fill expected staff shortages as unvaccinated nurses and hospital workers are fired effective tonight.

The governor of New York is calling in The National Guard to staff hospitals because of worker shortages brought on by a government mandate. How will they spin this to blame it on the "unvaccinated."

SARS-CoV-2; greater than 99% chance of survival, until age 69. The Pfizer vaccine is now approved for people aged 16 and up. Follow the science...

Tell me what you think.

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"