Swine Flu Video From 60 Minutes -- SHOW THIS TO AS MANY PEOPLE AS YOU CAN!

Try to get this out to as many people as you can. People need to see this to see the parallels to what we're dealing with right now with the COVID-19 "vaccines."

I don't know how much longer this will be on YouTube. They'll probably take it down once it gets enough views.

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

Vaccine Passports and HIPAA Laws! HIPAA is Already Relaxed. And You Thought They Couldn't Ask About Vaccines?

There's a lot to cover here, and I want to get it in with as few words as possible.

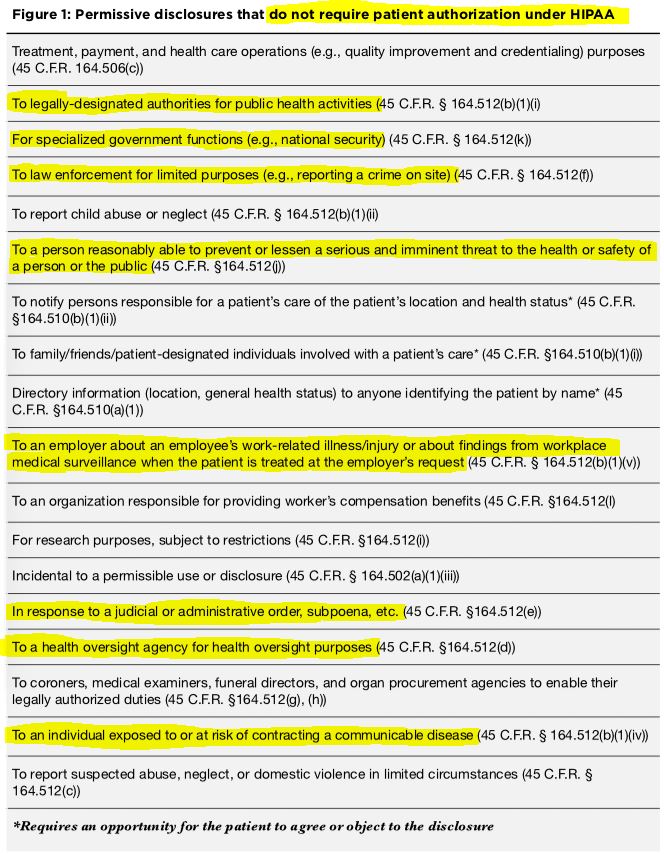

Most of the people who are speaking out about vaccine passports are doing so on the basis that your health information is private. They quote the Health Insurance Portability and Accountability Act or HIPAA. Your health information is NOT private. In fact it can be released for the following reasons:

As you can see the list is extensive. HIPAA was really designed to keep individuals from getting ahold of your medical records. What most people don't know is that HIPAA greatly increased access to your medical records for a number of reasons and for a number of institutions. Like anything else in the political world, those institutions and their designations can change over time. HIPAA was like any other law passed in Congress, it's intended purpose was the opposite of what its name suggests.

How many reasons can the government, or an agency (add company) get ahold of your medical history? Before relaxing the rules? See above, think of how many of those reasons could be used in a "pandemic." Now you understand why HIPAA will work against you when it comes to vaccine passports, not for you.

This brings me to my next point. HIPAA laws have recently been relaxed, giving the government and its designated authorities greater access to medical records in general.

In light of the ongoing COVID-19 pandemic and the need for an informed and coordinated public health response, U.S. Secretary of Health and Human Services (HHS) Alex Azar has declared a limited waiver of the following provisions of the HIPAA Privacy Rule. Beginning March 15, 2020, these provisions have been waived:

- Requirements to obtain a patient's agreement to speak with family members or friends involved in the patient’s care

- Requirement to honor a request to opt out of the facility directory

- Requirement to distribute a notice of privacy practices

- Patient's right to request privacy restrictions

- Patient's right to request confidential communications

This limited waiver is designed to facilitate the disclosure of patients’ protected health information in a number of specific circumstances connected to the ongoing pandemic

This waiver issued by Secretary Azar only applies under limited circumstances and is applicable:

- In the emergency area identified in the public health emergency declaration

- To hospitals that have instituted a disaster protocol

- For up to 72 hours from the time the hospital implements its disaster protocol. If the public health emergency declaration is terminated by the President or the Secretary before the end of this 72-hour period, then the hospital must return to compliance with the provisions of the Privacy Rule.

The whole country is the "emergency area identified in the public health emergency declaration!"

Coronavirus Disease 2019

When a national emergency was declared on March 13, 2020, we took action nationwide to aggressively respond to COVID-19.

You can read the blanket waivers for COVID-19 in the List of Blanket Waivers (PDF) UPDATED (4/9/2021).

The Public Health Service Act was used to declare a public health emergency (PHE) in the entire United States on January 31, 2020 giving us the flexibility to support our beneficiaries, effective January 27, 2020. The PHE was renewed on April 21, 2020, July 23, 2020, October 2, 2020, January 7, 2021, and April 15, 2021, effective April 21, 2021.

If you thought HIPAA was going to stop them from issuing vaccine passports, you were dead wrong.

How do we stop this from happening? I'm not sure. What I do know is that they desperately wish to implement a Corporate Social Credit System like in China.

The term “Corporate Social Credit System” is a somewhat of a misnomer, and the use of the word “system” is misleading, as it implies that the CSCS is a single, holistic, techno-regulatory apparatus, and that each policy under the social credit banner is a node in an integrated regulatory framework. In fact, while the data aggregation is centralized, the policy environment surrounding the CSCS is a disjointed mix of national and sector-specific policies, municipal pilot projects, and hybrid public-private sector cooperative agreements, loosely centered around the goal of enhancing market “trustworthiness.”

The CSCS has been chronically misunderstood outside of China. The system’s broad scope and technical and legal complexity, coupled with a lack of English-language primary source documentation on social credit, present significant barriers to understanding the realities of the system’s aims and functions. Without clear insight into the CSCS’s design, technologies, functions, policies, goals, and limits, U.S. policymakers and businesses are at a disadvantage in assessing how the CSCS may or may not evolve to negatively impact U.S. companies operating in China, or be leveraged by Chinese regulators to disadvantage or otherwise impact U.S. businesses. In this report, we draw on several thousand Chinese primary sources to describe what the system is and what it does.

So similar to our credit bureaus here, only in China they are determining your credit based on how you act, not your ability to repay debt. Apparently steering people with economic incentives just doesn't work well enough for the Chinese.

Multiple government bodies and state regulators control various blacklists relevant to their jurisdictional mandate and have administrative authority to determine which companies are added to such lists. Companies and individuals cannot be blacklisted on a completely arbitrary basis, as there are pre-determined types of violation that lead to blacklisting, but officials still hold discretionary power in terms of which violations are pursued and how severely violations are treated. China is currently working to further standardize the procedures for the creation of new blacklists, notifications, objections, blacklist removal and credit repair.

So yes, they can do whatever they want and there's nothing you can do about it.

This is a dark path to a dystopian future. If we start down this road, as the Chinese already have, we most likely will never come back.

Note: You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"

Candace Owens Telling The Truth!

This is a great clip with Candice Owens. She's telling exactly what's going on, and why.

She makes a really good point. The Republicans are not trying to fight this at all. Which is my point. But it's more than just that. Why have Republicans not been in this battle all along, before the narrative was completely controlled by the left? Now, if they do try to fight back they will be labeled as racists. But then, isn't that what they claim to have been worried about all along?

There are more Republicans involved with this whole thing than most realize. You can't use an excuse like, "I don't want to be labeled as racist" when the leftists are going to do that regardless of what you do! And if you haven't done anything racist, they'll find someone throughout history that you, your family, someone that can be tied to you, did --in the past that might be construed as racist.

Right now the deck is stacked against regular American citizens, regardless of race.

Ron DeSantis is one of the only governors that has been outspoken about the whole Critical Race Theory indoctrination curriculum. Why are so few states NOT blocking this Critical Race Theory garbage?

Now do you see the big picture? The Republicans are largely in on this whole globalists takeover as well. Republicans have taken two of the hundreds of steps that could have stopped all this. There's no way that the republicans are not in on the downfall of America.

Candice is 100% correct in what she's saying, but she's wrong in assuming that the Republicans are weak. Republicans are not weak, they are compromised. They agree with what's going on, that's why so few Republican governors have pushed back against poisoning the minds of children!

Why haven't all Republican governors pushed back against Critical Race Theory? Ask yourself that question.

Note: You DO NOT need to register to leave a comment.

In Oregon It's Masks FOREVER!

If anyone was questioning whether the mask mandates had anything to do with science, this should answer your question.

Oregon seeks to keep COVID mask mandate ‘indefinitely’

While some states are reopening businesses or dropping mask mandates altogether, Oregon is bucking the trend — floating an idea to require masks and social distancing indefinitely.

But not everyone is happy about the possible extension of the mask rules, which under state law expire on May 4. The agency has gotten a record number of public comments and nearly 60,000 people have signed a petition rejecting the proposal.

“When will masks be unnecessary? What scientific studies do these mandates rely on, particularly now that the vaccine is days away from being available to everyone?” said state Sen. Kim Thatcher, a Republican from Keizer, near the state’s capital.

Wood said he is reviewing the feedback and will make a final decision by May 4.

Michael Wood is administrator for the Oregon department of Occupational Safety and Health department. Wood said that he "will make a final decision by May 4." Because he gets to dictate what he wants, not based on science, but based on his decision making process. The fact that he's not saying that he'll let it expire means that he's going to extend it. There would be no reason NOT to come out now and tell people that you're going to let it expire.

During a House Select Subcommittee on the Coronavirus Crisis hearing on Thursday, Dr. Anthony Fauci, one of the top U.S. health officials on the COVID-19 pandemic, drew a road map for the country’s return to relative normality.

“What determines when?” Rep. Jim Jordan, a Republican from Ohio, challenged Fauci. The congressman said restrictions on movements and closures of businesses had impinged upon people’s rights to go to church and even leave their homes. He called it a year-plus-long loss of liberty.

Fauci, the director of the National Institute of Allergy and Infectious Diseases, replied, “You’re indicating liberty and freedom. I look at it as a public health measure to prevent people from dying and going to the hospital.”

“My message, Congressman Jordan, is to get as many people vaccinated as quickly as we possibly can to get the level of infection in this country low, [such] that it is no longer a threat. That is when, and I believe when that happens, you will see,” he said.

Also Thursday, Pfizer CEO Albert Bourla told CNBC that people will likely require a third vaccine dose after 12 months, and potentially annual vaccinations thereafter. When asked about the prospects for a next-generation vaccine that can fend off emerging variants of the coronavirus SARS-CoV-2, Fauci told the hearing that the endgame was a universal vaccine, the business-news channel reported.

Dr. Fauci says, "you will see." He gives absolutely no metric by which things can return to normal. Fauci DID NOT answer Jim Jordan's question. He refused to answer for a reason.

Consider, if you follow the logic, the reasoning for the "vaccines" is the cause for the lockdowns, as long as there is a need for these "vaccines" there's also a need for the lockdowns. If there is a need for continuous "vaccines" then there is no "return to normal" the lockdown shenanigans will be the "new normal." This has been the dirty little secret all along, the part that the legacy media refuses to talk about.

So get the "vaccine" and mask up people! Or don't and you'll be in the same boat, just without the experimental "vaccine(s)" coursing through your veins.

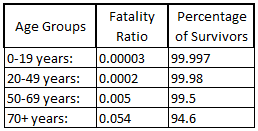

What were those survival statistics again?

People are being scared to death over these numbers! Just remember, they don't release the survival statistics on the CDC website, hell that would be useful. They list these "fatality ratios" because they know most people don't know how to convert them to percentages. Just more honesty from the people you can trust.

Note: You DO NOT need to register to leave a comment.