There Is Something Sinister Happening, But Most Will Miss It.

Terry Jones, the pastor who "says" he'll burn the Koran on 9/11 is getting much more than he expected. I'm not referring to all of the negative publicity from U.S. leaders, but that of leaders overseas. What's happening here should be noted.

The president of Indonesia, home of the world's largest Muslim population, called on the United States to ensure that no burnings took place.

"I continue to urge the government and the people of the United States to ensure the prevention of such an incomprehensible, irrational and immoral act," Susilo Bambang Yudhoyono said in a speech.

Both Muslim and Christian groups in Pakistan, another large mainly Muslim country, also denounced the planned action.

(Reporting by Ahmad Elham and Sayed Salahuddin; Additional reporting by Jakarta and Islamabad bureaux, Editing by Paul Tait and Ron Popeski)

We have a foreign leader saying that he wants the U.S. government to stop Terry Jones! Think about that for a minute. Where are the 1st Amendment Rights groups on this one?

I'm still wondering if the U.S. Constitution is going to be the law of the land? We DO NOT live in a theocracy. It would seem that the president of Indonesia doesn't understand our legal system, or is it that he doesn't care?

A foreign leader is feels as if the U.S. government should play a direct role in whether or not Terry Jones gets to torch the Koran. That foreign leader is not worried about what will happen in the United States or to the United States, they are worried about what will happen within their own countries.

That is the most telling part in all of this. Terry Jones is causing some in the world to take a second look at Islam.

When foreign leaders of majority Muslim populations are worried about violence in their country because 50 out of 340 million Americans get together to torch a book; you start to get the picture.

Why are some foreign leaders worried about violence when their countries are inhabited (primarily) with the followers of "The Religion of Peace"?!

Tell me what you think in the comments.

Note: You DO NOT need to register to leave a comment.

International Burn a Koran Day. Now this is interesting...

There is a church in Gainesville planning "International Burn a Koran Day". Take a peek at this clip.

“We feel it’s maybe the right time for America to stand up,” he said. “How long are we going to bow down? How long are we going to be controlled, by the terrorists, by radical Islam?”

“We feel it’s time for the church to stand up,” he added.

Jones also said that other churches ‘across the country’ have indicated they would support his, although he declined to name them.

The most telling part of this interview is where Jones mentions how a supporter in Paris emailed to say that he too is going to burn a Koran on 9/11.

There are a few people who say that this guy is wrong in what he is doing, but how is this any different from other causes out there?

This pastor has a valid point. What would happen if there were a Bible burning. Would there be protests, large riots and death threats from Christians? He also has a point when he says, "...we are only revealing the violence that is already there in that religion".

Gen. David Petraeus said Tuesday the Koran burning could endanger U.S. troops and the safety of Americans worldwide. He says images of the Koran burning would be used by Islamic extremists to inflame and incite violence.

While what Petraeus says is true, I have to take issue with the premise of his statement. Islamic extremists use our (Western Civilization) existence as a means to incite violence. We should do absolutely nothing to appease our enemy. I also fail to see how a Koran burning by a small group of people in Gainesville Florida is of any military significance when compared to the arbitrary deadline to leave Afghanistan. Of course Petraeus can't really comment on the deadline, but if he is worried about the Koran burning, you can bet he's worried about the deadline.

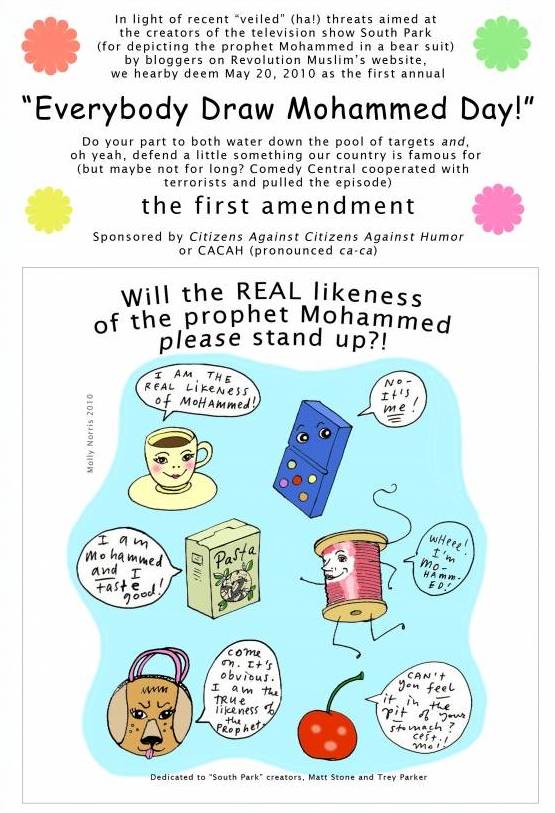

Remember the Internet craze "Everybody Draw Muhammad Day"?

Take a peek at the Wikipedia link. You'll be quite surprised by the amount of rage this stirred. Remember, this was only drawing pictures of Muhammad. Americans as a whole have been kept largely in the dark when it comes to what it means to be a Muslim. Not a "moderate Muslim" an "American Muslim" but a Muslim like those found in Islamic states.

Do I think torching a bunch of Korans is the best way to get a point across. No. Do I think it will be effective? Yes.

Remember the church that protests at U.S. service member's funerals, Westboro Baptist Church? The ACLU and the left stood strong for Westboro Baptist Church.

The American Civil Liberties Union filed the lawsuit Friday in the U.S. District Court in Jefferson City, Mo., on behalf of the fundamentalist Westboro Baptist Church, which has outraged mourning communities by picketing service members' funerals with signs condemning homosexuality.

The church and the Rev. Fred Phelps say God is allowing troops, coal miners and others to be killed because the United States tolerates gay men and lesbians.

My question is simple. Are the left in America going to stand up for the rights of this pastor Jones (who wants to burn Korans)? Or will they forget about the 1st Amendment and bow to the threat of Islamic Terrorism?

Note: You DO NOT need to register to leave a comment.

Imam Fiesal Abdul Rauf, We Have NOT Forgotten!

Can anybody believe this guy? This is the imam pushing the Cordoba initiative which is behind plans for a $100 million Islamic center about two blocks from Ground Zero in New York.

"We tend to forget, in the West, that the United States has more Muslim blood on its hands than Al Qaeda has on its hands of innocent non-Muslims," said Imam Fiesal Abdul Rauf, speaking at the Bob Hawke Prime Ministerial Center during a question and answer session dedicated to what sponsors say was a dialogue to improve relations between America and the Muslim world.

"You may remember that the U.S.-led sanctions against Iraq led to the death of over half a million Iraqi children. This has been documented by the United Nations," said Rauf, who called himself a spokesman for Islam.

But diplomats and others, including former President Bill Clinton, have said that sentiment is wrong. Saddam Hussein's regime corrupted then-U.N. sanctions and denied humanitarian aid to his own people.

Now the State Department is claiming they are aware of Imam Fiesal Abdul Rauf's controversial remarks. The remarks were made in 2005.

Wait a minute here, I think I've heard this rhetoric before... That's right these are the same views as Osama Bin Laden!

What is bin Laden's ideology?

Bin Laden and other militant Islamist leaders issued a 1998 manifesto denouncing the presence of American troops in Saudi Arabia, U.S. support of Israel, and the economic sanctions imposed after the 1991 Gulf War against Saddam Hussein's Iraq. "To kill Americans and their allies, both civil and military, is an individual duty of every Muslim who is able, in any country," the manifesto reads, "until their armies, shattered and broken-winged, depart from all the lands of Islam." Bin Laden regards Western institutions—coed schools, MTV, Rotary clubs, democracy itself—as depraved.

So why do we have an imam going over seas, spouting the same rhetoric we have heard from our enemies? How is this going to help to ease tensions between the Western and Muslim worlds? This imam has disgraced our nation by attempting to create a moral equivalency between the 9/11 attacks and U.S. foreign policy.

HERE IS THE MOST IMPORTANT --UNASKED QUESTION:

Nobody has asked this question, and it should be considered --by every American.

If the U.S. is indeed guilty of all the "crimes" listed by Imam Fiesal Abdul Rauf and Osama Bin Laden; short of becoming an Islamic state, what could the U.S. do to right its wrongs?

Therein lies the true center of this debate. What do these Muslim leaders expect the U.S. response to be? At what point would our "offenses" be forgiven? Do Americans think that U.S. submission is the answer?... I guarantee that is what Muslim leaders want.

Later in Chapter 3: What’s Right with America Imam Rauf takes it upon himself to blame the United States for any tension that remains between them and Muslims. He states, "If there is any quarrel Muslims have with America, it is that the United States does not always live up to its own ideal of ethics and values" (79). In sub-chapter America: A Sharia-Compliant State, Rauf states "(w)hat I am demonstrating is that the American political structure is Shariah compliant, for a 'state inhabited predominantly by Muslims neither defines nor makes it synonymous with an Islamic state. It can become truly Islamic only by virtues of a conscious application of the sociopolitical tenets of Islam to the life of the national, and by an incorporation of those tenets in the basic constitution of the country.' By the same token, a state that does incorporate such sociopolitical tenets has become a de facto Islamic state even if there are no Muslims in name living there, for it expresses the ideals of the good society according to Islamic principles. For America to score even higher on the 'Islamic' or 'Shariah Compliance' scale, America would need to do two things: invite the voices of all religions to join the dialogue in shaping the nation's practical life, and allow religious communities more leeway to judge among themselves according to their own laws" (86).

I say Hell No!

These Muslim leaders despise the U.S. because of the principles by which it was founded, it won't matter what the U.S. does to appease them.

The Middle East is like America's Gaza Strip. Any U.S. involvement in Muslim political affairs will be used as an excuse for future attacks. These are the views of our enemies. But don't take my word for it, just ask Imam Fiesal Abdul Rauf.

Note: You DO NOT need to register to leave a comment.

Nine Years Ago; Would Anyone Have Believed This Could Be An Issue?

A new survey reports a sharp increase in the number of Americans who, incorrectly, say President Obama is a Muslim. The increase has occurred over the last couple of years, and the poll was taken before the president stepped into the fray of the Ground Zero mosque controversy.

The findings are part of the "Religion, Politics and the President" poll conducted by the Pew Forum on Religion and Public Life early this month. It also explores Americans' attitudes toward religion's impact on society and voting preferences in the upcoming 2010 congressional races.

According to the survey, nearly one in five Americans (18 percent) say Obama is a Muslim, up from 11 percent in 2009. Obama is a Christian, but the number of people say Christian when asked his religion has gone down sharply, from 51 percent in 2008 to 34 percent today. And 43 percent say they don't know what religion the president follows.

That last part is the most shocking to me. 43% say they don't know what religion Obama follows! That is a really big deal! People aren't sure what religion The President of The United States follows!? Why, he must have done something to cast some doubt amongst people.

In foreign policy as well, Mr. Obama would bring to the White House an important experience that most other candidates lack: he has actually lived abroad. He spent four years as a child in Indonesia and attended schools in the Indonesian language, which he still speaks.

“I was a little Jakarta street kid,” he said in a wide-ranging interview in his office (excerpts are on my blog, www.nytimes.com/ontheground). He once got in trouble for making faces during Koran study classes in his elementary school, but a president is less likely to stereotype Muslims as fanatics — and more likely to be aware of their nationalism — if he once studied the Koran with them.

Mr. Obama recalled the opening lines of the Arabic call to prayer, reciting them with a first-rate accent. In a remark that seemed delightfully uncalculated (it’ll give Alabama voters heart attacks), Mr. Obama described the call to prayer as “one of the prettiest sounds on Earth at sunset.”

Moreover, Mr. Obama’s own grandfather in Kenya was a Muslim. Mr. Obama never met his grandfather and says he isn’t sure if his grandfather’s two wives were simultaneous or consecutive, or even if he was Sunni or Shiite. (O.K., maybe Mr. Obama should just give up on Alabama.)

Our biggest mistake since World War II has been a lack of sensitivity to other people’s nationalism, from Vietnam to Iraq. Perhaps as a result of his background, Mr. Obama has been unusually sensitive to such issues and to the need to project respect rather than arrogance. He has consistently shown great instincts.

Oh that's right, Obama tried to be on both sides in the Ground Zero mosque debate. Yeah that's the only thing making people wonder...

Here is an earlier post I did related to the whole question of Obama's religious beliefs.

Maureen Dowd thinks that Bush did a better job of explaining The War On Terror/Radical Islam when compared to Barack Obama? I thought that Obama was supposed to be one of the most brilliant presidents. Now he's flip flopping on the subject of the Ground Zero mosque --within a two day period!

Maybe, for Barack Obama, it depends on what the meaning of the word “is” is.

When the president skittered back from his grandiose declaration at an iftar celebration at the White House Friday that Muslims enjoy freedom of religion in America and have the right to build a mosque and community center in Lower Manhattan, he offered a Clintonesque parsing.

“I was not commenting, and I will not comment, on the wisdom of making the decision to put a mosque there,” he said the morning after he commented on the wisdom of making a decision to put a mosque there. “I was commenting very specifically on the right people have that dates back to our founding. That’s what our country is about.”

Let me be perfectly clear, Mr. Perfectly Unclear President: You cannot take such a stand on a matter of first principle and then take it back the next morning when, lo and behold, Harry Reid goes craven and the Republicans attack. What is so frightening about Fox News?

The war against the terrorists is not a war against Islam. In fact, you can’t have an effective war against the terrorists if it is a war on Islam.

George W. Bush understood this. And it is odd to see Barack Obama less clear about this matter than his predecessor. It’s time for W. to weigh in.

This — along with immigration reform and AIDS in Africa — was one of his points of light. As the man who twice went to war in the Muslim world, he has something of an obligation to add his anti-Islamophobia to this mosque madness. W. needs to get his bullhorn back out.

She then goes on to say how "hyper-articulate" both Obama and Clinton are. This, of course, right after she mentioned how Obama is incapable of conveying his thoughts. Oh well...

I wonder why Obama has such a hard time expressing himself when it comes to his personal beliefs. He seems to have no problem telling the American people what they should believe.

Note: You DO NOT need to register to leave a comment.

"A strong and durable recovery also requires countries not having an undue advantage." Hmm...

There are a few things going on that don't add up. We have the G-20 where there are foreign leaders telling the U.S. that they are NOT going to keep spending in order to "prime the economic pump" mainly because it's not working.

On the other hand we have a president who for some reason to spite all of the historical evidence thinks that we can spend our way to prosperity. There are many problems with this line of thinking to say the least. It's when Obama said this that my jaw dropped.

"After years of taking on too much debt, Americans cannot -- and will not -- borrow and buy the world's way to lasting prosperity," Obama declared, in an implicit swipe at export-led economies such as China's and Germany's.

"No nation should assume its path to prosperity is paved with exports to America. Indeed, I've made it clear that the United States will compete aggressively for the jobs and industries and markets of the future."

"A strong and durable recovery also requires countries not having an undue advantage," Obama said, demanding "currencies that are market-driven."

In order to have market driven currencies governments would have to stay out of the market. If currencies are market-driven who is to say when there is an undue advantage? If it were determined that there was somehow an undue advantage; how in a market driven society would you alter things to "make it equal?"

Of course this is a swipe at China, who holds U.S. currency to purposely inflate their own currency (keeping the value of their currency lower in relation to the U.S. dollar). This has been going on now for years.

So, we have a president who said that he is not interesting in running a car company, then demands the resignation of GM's CEO. Does anyone really take the U.S. seriously anymore? I don't think that the Chinese do.

Note: You DO NOT need to register to leave a comment.