Obama finally gets CALLED OUT. Sen. Charles Grassley of Iowa

In the past week, Obama's proposals for major health care, energy and education changes amid a recession faced skepticism from both Democrats and Republicans on Capitol Hill. North Dakota Sen. Kent Conrad, the Democratic chairman of the Budget Committee, called the track of future deficits "unsustainable."

Obama is projecting a federal deficit of $1.75 trillion this year, by far the largest in history, but says he can get it down to $533 billion by 2013.

On Saturday, Grassley criticized Obama's proposals for tax increases as failing "to connect all the dots." The senator said the major tax increases will only force people to drop out of the work force, reducing tax revenue to pay down the deficit.

"There's evidence that the president and his people understand this, even if their budget doesn't show it," Grassley said. "They say they don't want to raise taxes until 2011 because the economy is too weak. ... Well, if the president admits that tax increases hurt the economy, that will be true in two years as it is true today."

Why has the media been sleeping on this? I've blogging about this for some time now. I don't understand why people think it's a good idea to weaken our own economy. Why would our own people want this?

Is it the fact is that most people don't know what's going on; or even worse don't care.

Note: You DO NOT have to register to leave a comment.

Global economic lessons; for those who missed the wolf metaphor at the beginning of "300"

There are many things going on in the world today that are simply not making front page news. Does this mean that they are any less important?

Chinese Premier Wen Jiabao on Friday urged the US to take measures to guarantee its “good credit”, expressing concern about the “safety” of his country’s huge holdings of US government debt.

Mr Wen’s shot at the US’s deteriorating fiscal position – on the eve of this weekend’s G20 finance ministers’ meeting – was paired with a promise to increase China’s public spending this year to boost its economy if needed.

The Chinese government is the largest holder of US public debt and Chinese officials have shown increasing signs of concern that the sharp increase in US government spending will lead eventually to inflation and a collapse in the dollar.

About 70 per cent of China’s near-$2,000bn foreign exchange reserves are believed to be in US dollar assets.

“We have lent a huge amount of money to the United States,” Mr Wen told the annual press conference that marks the close of the National People’s Congress, China’s parliament.

“Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried. I request the US to maintain its good credit, to honor its promises and to guarantee the safety of China’s assets.”

So the Chinese are concerned now that the United States might not be able to "make good" on it's debt. This does raise some concerns; considering that the Chinese would take this stance. Does it mean, perhaps, that the Chinese know something that our "economists" don't?

Larry Summers, US President Barack Obama’s senior economic adviser, responded by trying to quell fears over the burgeoning mountain of US debt, saying that boosting the economy would help reduce debt in the future.

“If you don’t prime the pump . . . it’s much more costly to do it later,” he said in response to a question about Mr Wen’s comments.

The US was committed to long-term fiscal stability, he said, but it was more responsible to US debt holders to ensure that the economy recovered rapidly from recession.

So we are telling the Chinese that we are going to honor our debt by borrowing more money from them? I think there is "fuzzy logic" at play here, and I'm going to point it out.

http://www.ft.com/cms/s/0/6fb02cf4-0c4b-11de-b87d-0000779fd2ac.html?nclick_check=1

Widely seen as being among the most pro-market voices in the White House, having been Bill Clinton's last Treasury secretary in the 1990s, Mr Summers said that the view on whether the market was inherently self-stabilizing had been "dealt a fatal blow".

He also urged world leaders to pump more public money into the economy in a coordinated effort to boost demand and lift the world out of recession.

The urgent need for a short-term increase in spending by governments temporarily overrode the longer-term goal of tackling the global imbalances many economists believe caused the financial crisis, he said.

His comments, ahead of next month's crunch Group of 20 summit in London, make clear that the US administration wants industrialized nations to share responsibility for engineering a global demand-led recovery and does not believe this burden should fall on China alone.

"The old global imbalances agenda was more demand in China, less demand in America. Nobody thinks that is the right agenda now," said Mr Summers. "There's no place that should be reducing its contribution to global demand right now. It is really the universal demand agenda."

While the US and other western nations should return to living within their means in the medium term, everyone should raise spending sharply now. "The right macroeconomic focus for the G20 is on global demand and the world needs more global demand," said Mr Summers.

At a time when the Republican critique of Washington's aggressive response to the crisis is growing more trenchant, Mr Summers made an unapologetic case for state intervention.

"This notion that the economy is self-stabilizing is usually right but it is wrong a few times a century. And this is one of those times . . . there's a need for extraordinary public action at those times and that's a clear lesson of today." The suggestion that the financial crisis had been caused by too much government intervention, as many in the Republican party argue, was simply wrong, he said.

There are a few things at play here that, for the most part, are over looked. The idea that the a government can "create demand" is based on an economic model theorized by John Maynard Keynes. I covered this theory in a comment to another viewer.

Keynes argued that the solution to depression was to stimulate the economy ("inducement to invest") through some combination of two approaches: a reduction in interest rates, and government investment in infrastructure. Investment by government injects income, which results in more spending in the general economy, which in turn stimulates more production and investment involving still more income and spending and so forth. The initial stimulation starts a cascade of events, whose total increase in economic activity is a multiple of the original investment.

A central conclusion of Keynesian economics is that in some situations, no strong automatic mechanism moves output and employment towards full employment levels. This conclusion conflicts with economic approaches that assume a general tendency towards an equilibrium. In the 'neoclassical synthesis', which combines Keynesian macro concepts with a micro foundation, the conditions of general equilibrium allow for price adjustment to achieve this goal.

The New classical macroeconomics movement, which began in the late 1960s and early 1970s, criticized Keynesian theories, while New Keynesian economics have sought to base Keynes's idea on more rigorous theoretical foundations.

More broadly, Keynes saw his as a general theory, in which utilization of resources could be high or low, whereas previous economics focused on the particular case of full utilization. However, after reading Hayek's criticism, The Road to Serfdom, he agreed that "the theory of aggregated production, which is the point of the [General Theory], nevertheless can be much easier adapted to the conditions of a totalitarian state [eines totalen Staates] than the theory of production and distribution of a given production put forth under conditions of free competition and a large degree of laissez-faire."

The theory that Larry Summers is basing his assumptions on; requires massive government control of resources and the market as a whole. This is why he, "wants industrialized nations to share responsibility for engineering a global demand-led recovery". The model will not work correctly within a free market global economy, as admitted by Keynes himself. Also the Keynes' theory does not account for a large deficit; nor in theory was the government investment made with borrowed money.

The other problem is that we are spending money at a rate that cannot be maintained. There is no long term approach here. When the bridges are built, roads repaired, and the buildings are "eco-friendly", then what? Where did all of the jobs go? The government can only create short term economic demand. Just as George W. Bush was criticized by John Kerry in the "War On Terror" for not, "Having a plan to win the peace". There is no long term plan to prosperity here.

The health care industry in the United State makes up 17% of GDP. http://www.nchc.org/facts/cost.shtml That's nearly one quarter of the the GDP that is going to be taken away, when the government begins to offer health insurance. The GDP will drop by a large percentage because the money the government will spend on health care is really just redistributed wealth. The government cannot create wealth.No new economic growth will spawn from government subsidized health care.

The current U.S. government economic stance is causing fear in global markets. The Chinese know that our current path is not sustainable. Chinese investments in the U.S. economy are based on potential returns, not IOU's.

Note: You DO NOT have to register to leave a comment.

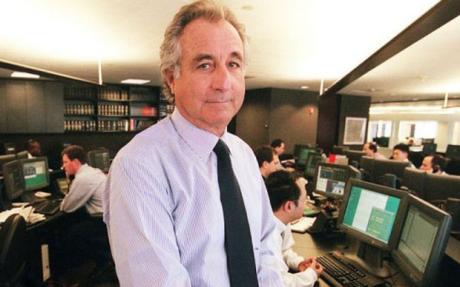

Bernard Madoff, going to jail, but where did the money go?

http://www.bloomberg.com/apps/news?pid=20601087&sid=aewkjJesFa2U&refer=worldwide

In a slow news day what is one to do?

Where do you think the money went?

Note: You DO NOT have to register to leave a comment.

Remarks of President Barack Obama Earmark Reform The White House March 11, 2009

Obama is requesting that Senators and House members post earmarks on their websites for scrutiny before they are passed into law. I don't see how this would have helped with the last spending bill? If Congress is going to ram legislation through in just days, how is this going to help?

http://www.c-span.org/pdf/obama_031109.pdf

Remarks of President Barack Obama

Earmark Reform

The White House

March 11, 2009I ran for President pledging to change the way business is done in Washington and build a government that works for the people by opening it up to the people. That means restoring responsibility, transparency, and accountability to the actions government takes. And working with the Congress over my first fifty days in office, we’ve made important progress toward that end.

Working together, we passed an American Recovery and Reinvestment Act that is already putting people back to work doing the work Americans need done. And we did it without the customary Congressional earmarks – the practice by which individual legislators insert projects of their choosing. We are implementing the Recovery Act with an unprecedented level of aggressive oversight and transparency, including a website – Recovery.gov – that allows every American to see how their tax dollars are spent and report on cases where the system is breaking down.

I signed a directive that dramatically reforms our broken system of government contracting, reining in waste, abuse and inefficiency; saving the American taxpayer up to $40 billion each year in the process.

And I have laid out plans for a budget that begins to restore fiscal discipline so we can bring down the $1.3 trillion budget deficit we inherited and pave the way for our long-term prosperity. For the first time in many years, we’ve produced an honest budget that makes the hard choices required to cut our deficit in half by the end of my first term in office.

Yesterday, Congress sent me the final part of last year’s budget; a piece of legislation that rolls nine bills required to keep the government running into one – a piece of legislation that addresses the immediate concerns of the American people by making needed investments in line with our urgent national priorities.

That is what nearly 99 percent of this legislation does – the nearly 99 percent you probably haven’t heard much about.

What you likely have heard about is that this bill does include earmarks. Now, let me be clear: Done right, earmarks give legislators the opportunity to direct federal money to worthy projects that benefit people in their district, and that’s why I have opposed their outright elimination. I also find it ironic that some of those who railed the loudest against this bill because of earmarks actually inserted earmarks of their own – and will tout them in their own states and districts.

But the fact is that on occasion, earmarks have been used as a vehicle for waste, fraud, and abuse. Projects have been inserted at the eleventh hour, without review, and sometimes without merit, in order to satisfy the political or personal agendas of a given legislator, rather than the public interest. This practice hit its peak in the middle of this decade, when the number of earmarks had ballooned to more than 16,000, and played a part in a series of corruption cases.

In 2007, the new Democratic leadership in Congress began to address these abuses with a series of reforms I was proud to have helped write. We eliminated anonymous earmarks and created new measures of transparency in the process, so Americans can better follow how their tax dollars are being spent. These measures were combined with the most sweeping ethics reforms since Watergate. We banned gifts and meals and made sure that lobbyists have to disclose who they’re raising campaign money from, and who in Congress they send it to.

We have made progress. But we must do more.

I am signing an imperfect omnibus bill because it is necessary for the ongoing functions of government. But I also view this as a departure point for more far-reaching change.

In my discussions with Congress, we have talked about the need for further reforms to ensure that the budget process inspires trust and confidence, not cynicism. So I believe as we move forward, we can come together around principles that prevent the abuse of earmarks.

These principles begin with a simple concept: earmarks must have a legitimate and worthy public purpose. Earmarks that members do seek must be aired on those members’ websites in advance, so the public and the press can examine them and judge their merit for themselves. And each earmark must be open to scrutiny at public hearings, where members will have to justify their expense to the taxpayer.

Next, any earmark for a for-profit private company should be subject to the same competitive bidding requirements as other federal contracts. The awarding of earmarks to private companies is the single most corrupting element of this practice, as witnessed by some of the indictments and convictions we have seen. Private companies differ from the public entities that Americans rely on every day – schools, police stations, fire departments – and if they are seeking taxpayer dollars, then they should be evaluated with a higher level of scrutiny.

Furthermore, it should go without saying that an earmark must never, ever be traded for political favors.

And finally, if my administration evaluates an earmark and determines that it has no legitimate public purpose, we will seek to eliminate it, and we will work with Congress to do so.

I know there are members in both houses with good ideas on this matter. Just this morning, the House released a set of recommendations for reform that hold great promise, and I congratulate them on that.

Now, I am calling on Congress to enact these reforms as the appropriations process moves forward this year. Neither I nor the American people will accept anything less.

It’s important that we get this done to ensure that the budget process works better, that taxpayers are protected, and that we save billions of dollars that we so desperately need to right our economy and address our fiscal crisis. Along with that reform, I expect future spending bills to be debated and voted on in an orderly way, and sent to my desk without delay or obstruction, so that we don’t face another massive, last-minute omnibus bill like this again.I recognize that Congress has the power of the purse, and as a former Senator, I believe that individual members of Congress understand their districts best. They should have the ability to respond to the needs of their communities. But leadership requires setting an example, and the magnitude of the economic crisis we face requires responsibility on all our parts.

The future demands that we operate in a different way than we have in the past. So let there be no doubt: this piece of legislation must mark an end to the old way of doing business, and the beginning of a new era of responsibility and accountability that the American people have every right to expect and to demand.

If we are going to solve our economic crisis; if we are going to put Americans back to work; if we are going to make the investments required to build a foundation for our future growth – then we must restore the American people’s faith that their government is working for them, and that it is on their side. That is the government I promised. That is the government I intend to lead.

Note: You DO NOT have to register to leave a comment.

Is China "testing the waters"?

Chinese Navy gets a little too close for comfort...

http://news.bbc.co.uk/2/hi/asia-pacific/7933171.stm

Five Chinese ships have manoeuvred dangerously close to an unarmed US navy surveillance vessel in the South China Sea, the US government says.

The ships "aggressively manoeuvred" around the Impeccable "in an apparent co-ordinated effort to harass the US ocean surveillance ship while it was conducting routine operations in international waters", according to the Pentagon.

Impeccable is designed specifically to detect underwater threats such as submarines for the US navy.

The US ship sprayed one Chinese vessel with water from fire hoses to try to force it away, the Pentagon said. But the Chinese crew stripped to their underwear and carried on approaching to within 25ft 8m), it added.

When the Impeccable radioed requesting a safe path to leave the area, two Chinese vessels dropped pieces of wood in its path, forcing the US ship to make an emergency stop, the Pentagon said.

The Pentagon reported three other naval incidents involving China last week:

* On Wednesday, a Chinese Bureau of Fisheries Patrol vessel used a high-intensity spotlight to illuminate the ocean surveillance ship USNS Victorious in the Yellow Sea and, the next day, a Chinese Y-12 maritime surveillance aircraft conducted 12 fly-bys of Victorious.

* On Thursday, a Chinese frigate approached Impeccable without warning and crossed its bow at a close range of approximately 100m (yards), after which a Y-12 aircraft conducted 11 fly-bys. The frigate later crossed the US ship's bow again.

* On Saturday, a Chinese intelligence collection ship challenged Impeccable over bridge-to-bridge radio, calling her operations illegal and directing her to leave the area or "suffer the consequences".

This is not a good thing. Some think that the Chinese might just be pushing a little.

At issue in Sunday's incident is the manner in which the US navy says the Chinese vessels went beyond the usual boundaries in shadowing and harassing the Impeccable, the BBC's Kevin Connolly notes.

This may be an example of China testing the mettle of a new US administration, just as it did when it impounded a US reconnaissance aircraft immediately after George W Bush took office, he says.

It held the crew of the plane, which was in collision with a Chinese fighter jet, for 11 days, causing a serious diplomatic row between the two countries.

While relations between Beijing and Washington are complex, any sense of military competitiveness is dwarfed by America's need for China to continue buying US debt to fund its huge and growing deficit, our correspondent adds.

This is one example of how running a large deficit can be a dangerous thing. Making the deficit larger at this time is not wise. This shows how unfriendly countries can, and will, take advantage of the situation.

Note: You DO NOT have to register to leave a comment.