| « The Debate Needs to Shift to Why The 2020 Election Was Rigged | The Jan 6th Narrative Keeps Getting More Absurd as Time Goes On » |

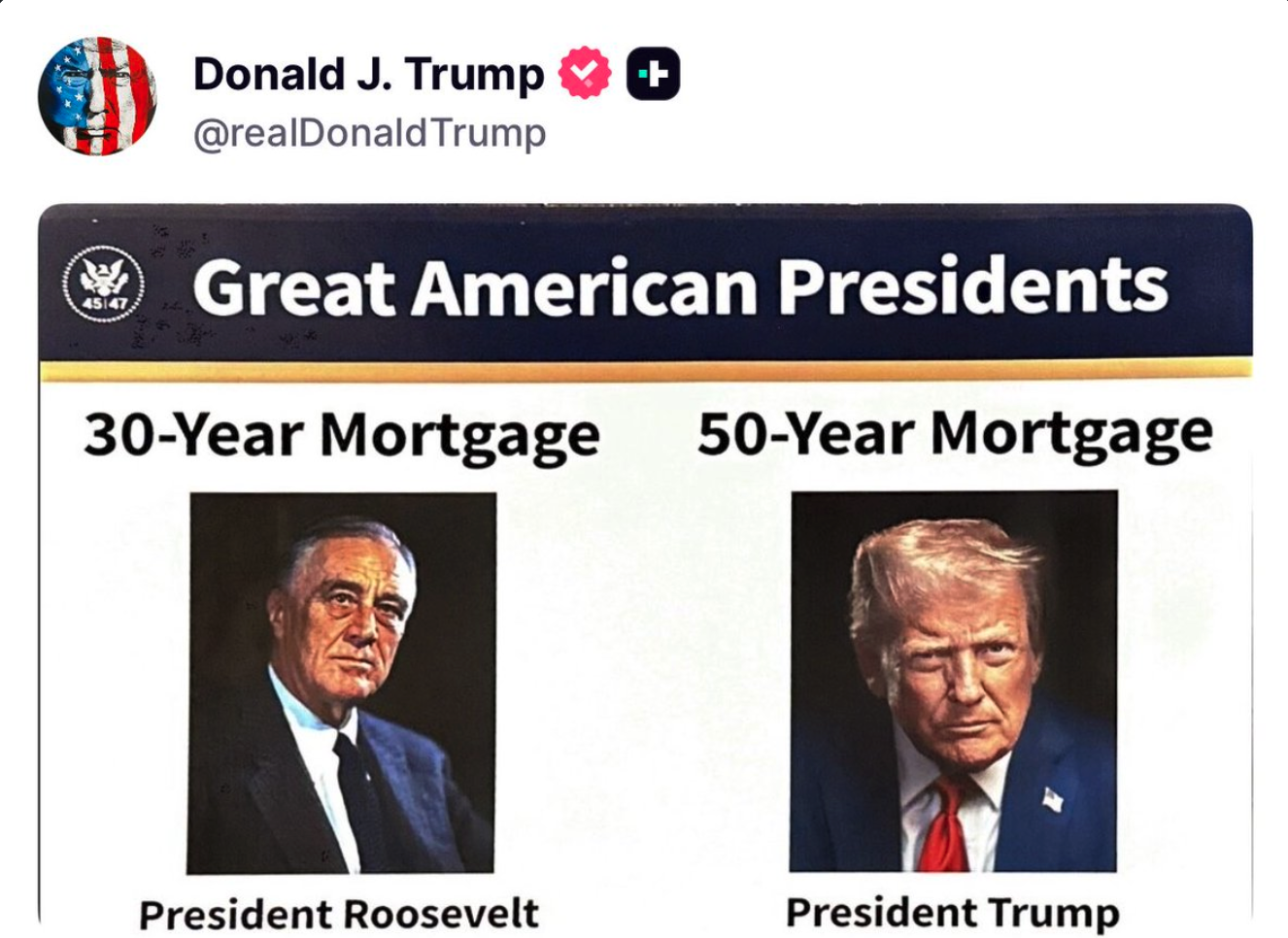

50-Year Mortgages Will Not Make America Great Again

Trump is killing his own movement with this move, should it go through.

I'm not going to get into all the history on this, as it won't be very relatable to many people, including myself -- at least not as mortgage terms go.

This proposal is interesting to me because traditional life insurance policies (not term policies) are based on a 100-year interval. Meaning that you pay into your $100k policy until you are 100 years old. Once you reach the 50-year mark, you’re actually getting your own money back. The insurance company is only in for half, and that’s assuming that they made nothing off your donations principle payments (which we know is not true).

A 50 year mortgage would mean that pretty much nobody would “own” a home anymore, from this point on, because nobody is going to outrun inflation to the point that they pay off they loan earlier (some will, but the vast majority won’t, we know this). Nearly all future properties will be bank owned. That being the case, why not just push the mortgages out to 100-years? Trust me, they would if they could, but 100-years is considerably beyond the average life expectancy in the US. 100-year mortgages would quite literally give up the game, it would be too obvious.

This is an absolute dream for the financial, and real estate markets, they can’t get enough of this.

Endless interest payments – pretty much for the life of all new homeowners. Don’t forget about PMI insurance – they’ll be collecting long after the occupant has paid in an amount equal to 20% of the property value at the time of purchase.

Quick explanation: PMI (Private Mortgage Insurance) is supposed to secure the bank for the amount of the loan that you didn't put down up to 20%. If you put down 10% then you will carry PMI for the remaining 10% equaling 20% of the total property value. If you can put down 20% initially, you are not required to carry PMI.

We know that most first-time homebuyers are not putting down 20%. That's why this insurance is a slam dunk. PMI covers the bank (not the homebuyer) for 20% of the property value at the time of purchase, should the lender default on the loan. Keep in mind, the bank already owns the property if they agree to allow the homebuyer to mortgage it through them. The bank buys the property and sells it to you (with interest) over 30-years or in this case 50-years.

Seems a little odd doesn't it? If the loan defaults, the property is already in the hands of the bank, they can just sell it again. Oh, and they get to keep that down payment up to 20% of the property value. Not to mention that all property is generally considered to be an appreciating asset. The bank just can't lose.

The opposite is true with an auto loan. You can get Gap Coverage which will satisfy the loan should the owner die, or the car is totaled in an accident. But that covers the person paying the loan (car buyer), and the bank. Cars are depreciating assets, so this makes more sense.

PMI is one of the top legal scams out there. And those insurers are salivating at the possibility of having people, required by law, to pay for their product. Keep in mind they will make a killing because of the already inflated housing prices.

The 50-year mortgage is NOT a good idea. President Trump, how about letting the market correct?

50-year mortgages will just keep home prices artificially high. Banks will own the majority of property from this point forward, and "homebuyers" (loan payers) will make endless payments. The end result will be as if most people, from that point on, will be living in an apartment (forever paying, and never owning). Only when you live in an apartment, you don’t have to pay property taxes, buy a new air conditioning unit, water heater, or pay to replace the roof when the time comes.

This is a bailout to property owners and banks -- not "relief" for first-time homebuyers.

Of course, the counter argument to this will be, if interest rates drop, homebuyers will be able to refinance into a 30-year mortgage at a better interest rate. Sure, that's possible. But who wants to gamble the next 50-years of their life -- based on the whims of The Fed? Democrats will be in power again, at some point, and none of that will bode well for those poor 50-year loan holders.

We'll just have to see where this goes.

I'm afraid that Trump is likely to mess this up “BIGLY.”

What do you think?

If you enjoy my writing, you could buy me a Ko-Fi 😉👉

Please leave a comment, like it or hate it... You DO NOT need to register to leave a comment. Email addresses are NOT used. Just make one up "someone@somehost.com"